How can YOUR business benefit from hiring a MWBE

(Minority and/or Woman Owned Business Enterprise)?

Answer: To fulfill the NYS’s and NYC’s MWBE program’s purpose:

-

Companies that source minority owned business or MWBE suppliers can see benefits in the form of tax incentives, rebates and breaks. Offered by a variety of governmental agencies, these tax incentives can provide significant tax savings or credits for MWBE-subcontracted work.

-

In an effort to meet compliance requirements of federal or state government customers, utilizing MWBEs have both intangible and economical benefits. Today, numerous businesses rely heavily on federal and state government purchases or contracts to bolster their revenue. Often, federal, state and even local government clients require companies to maintain a certain level of MWBE spend before they will even consider doing business with them. New York State requires a 30% spending goal with MWBEs. Maintaining this level of spend could potentially open your business up to more government contract or purchase opportunities!

-

Smaller minority and women owned businesses could offer more flexibility and agility in comparison to larger suppliers.

-

Smaller MBE companies could potentially offer cost savings due to passed-along supply chain and overhead cost savings.

-

Additionally, large corporations have found that increased supplier diversity can be valuable in pursuing diversity accomplishments which in turn can strength brand identity and marketing efforts.

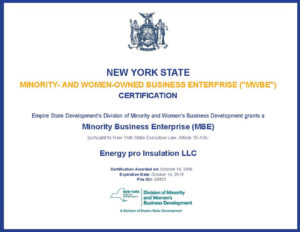

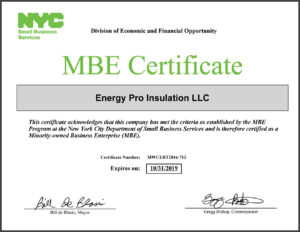

EnergyPro is Proud to be Certified by both New York State and New York City as a Minority-Owned business

For our Capabilities statement: Click Here

If you need to satisfy the MWBE fulfillment for your next project:

Click here to Contact Us by email or Call 718.984.7211